Buy MoneyTime today

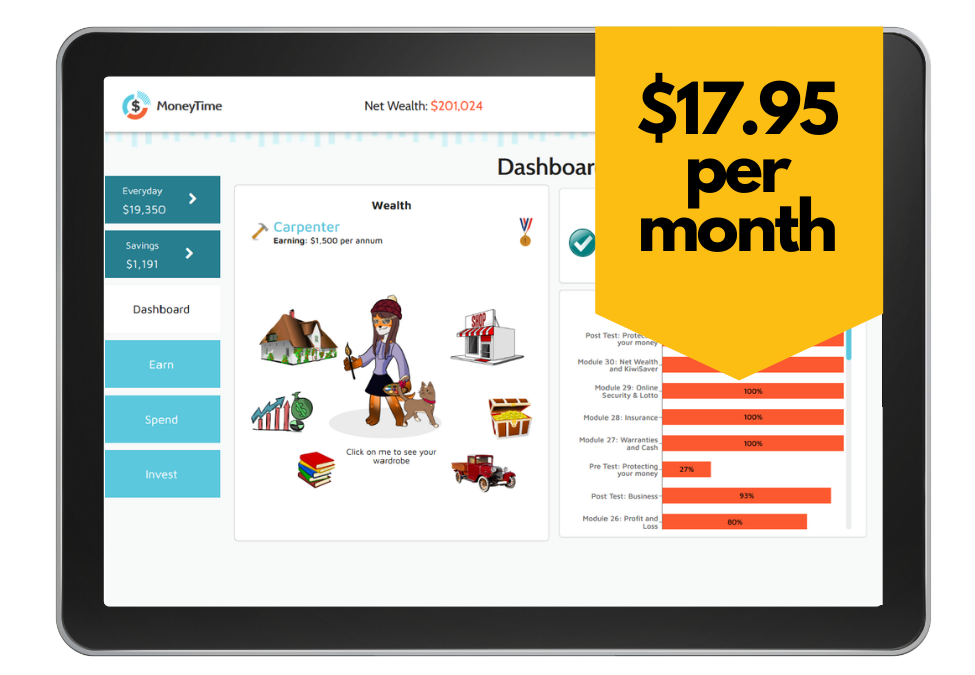

Monthly subscription $17.95

Add additional children for $13.50/mo each and save 25%

No minimum contract

Cancel at anytime easily through your Customer Portal

Annual license $89

Add additional children for $67 each and save 25%

One time payment. No re-occurring billing.

60 Day money back guarantee

Australian version now available

MoneyTime has been customised for Australia and is available for purchase in AUD.

What parents are saying

Teaching children to be money smart while they are still under your financial responsibility will set them up with positive financial habits. And the MoneyTime financial literacy curriculum is the best online programs on financial literacy for kids we’ve found.

— Charlene Hess

You could spend hours scouring the internet for the best course on investing for kids or I could just tell you right now to head on over to the MoneyTime website and save you a whole heap of time and trouble.

— Tonya Nolan

MoneyTime is fantastic! Since my children began the program they've started a business, are growing plants and hatching chickens to sell, and have created resumes and applied for jobs. We've always had many conversations about money, but MoneyTime has provided the motivation for action. Thank you for an incredibly practical and useful resource!

— Kelly George

Our son completed the program and it was fantastic. Really impressed! It is definitely a worthwhile investment. Many thanks for bringing MoneyTime into our children's lives.

— David Crowther

I am always looking for programs that encourage independence. I knew this one was a winner minutes after we signed in. This was a sign-on and go program for my son. I didn’t need to explain or look over his shoulder. He took off flying and gave himself a job of pulling weeds and raking leaves in our neighborhood. Really this is hilarious if you know my son. My favorite part is that the program engages kids with a reward system that directly relates to learning the concepts.

— Ashley Fox

Frequently Asked Questions

How long will it take my child to complete the program?

This really depends on your child and how many lessons they complete each week. We advise allowing 30 minutes per lesson. If your child completes 2 lessons (1 hour) a week, it will take them 5 months to complete.

How can I manage or cancel my monthly subscription?

We have a Customer Portal in place that makes it easy to manage or cancel your subscription without needing to contact us. The link to the Customer Portal is included in every invoice you receive and on the footer of our website so you can access it at anytime.

How much guidance will my child need to use MoneyTime?

None! MoneyTime has been built to be self taught. This means you can be as involved as you want to be. You can leave your child to use the program, or you can work through the MoneyTime with your child using the Study Guide provided which is full of guidance and practical activities.

What happens after I purchase MoneyTime?

We know you’re busy, so there are no webinars to watch, books to read or programs to download. On completion of purchase, you will receive an email containing your license keys and instructions on how to set up your parent account. You can then add your children to your account. Once your child has logged in, they’re shown a welcome video and then they’re good to go! MoneyTime can be used on any desktop or tablet that has an internet connection.

How do the Parent - Child modules work?

Within the program there are 13 Parent - Child modules. These are completely optional but are highly recommended. They are specifically designed for you to complete with your child. By doing these modules together they help reinforce your child’s learning and, most importantly, they put their learning into your family context; and they give you an opportunity to have some real conversations about money and the future with your children.

Included in MoneyTime

30 Highly interactive and practical personal finance lessons

13 Parent child lessons specifically designed for you to do with your child

Parent Study Guide full of guidance and practical activities

Automatically marked quizzes

Awards, leader board, certificates

Instant access

60 Day Money Back Guarantee

You can try MoneyTime annual licenses completely risk free.

If you’re not happy we’ll refund you in full!

MoneyTime will teach your child everything you wish you had been taught about money

Monthly subscription $17.95

Add additional children for $13.50/mo each and save 25%

No minimum contract

Cancel at anytime

Annual license $89

Add additional children for $67 each and save 25%

One time payment. No re-occurring billing.

60 Day money back guarantee

If you can help your child avoid one just one bad financial decision, it will cover the cost of the program many times over

Feedback from parents

My Kids love this program. Even my surly teenage son. He has just been explaining how he invested in training in the program to get a better job and has been investing virtual money. He has now started saving more and spending less real money from his casual job.

— Christian Todd

The great thing about this is that it takes the learning out of a game and makes it real since you are talking about your own family’s choices. If you have kids who like to spend time on the computer, this online program on financial literacy for kids is just the ticket. After using the program for a couple of months I would say yes, it is worth the money because it is a very thorough program that covers a lot of topics that your kids need to know.

— Sheila Rogers

You can’t manage money without understanding how it works, but money is complicated! This is where a program like MoneyTime is gold! This program is very thorough! It teaches the basics, like how a savings account works. Kids have the option of investing in education for higher future earnings. They also get to see how different career choices lead to different earning potential. But that’s only the beginning!

— MaryAnne Kochenderfer